Master Inheritance Tax Tips: Navigating State & Federal Laws

Inheritance laws vary between states and countries, dictating asset distribution while respecting le…….

Introduction

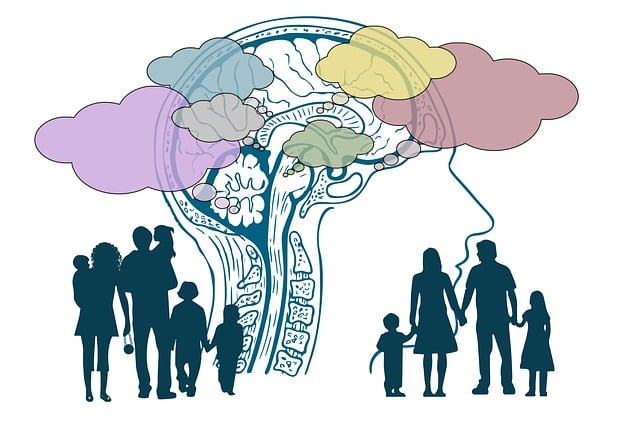

Estate and inheritance planning is a critical aspect of financial management that involves organizing an individual’s assets before and after death to benefit their heirs, minimize taxes, and ensure the smooth transfer of assets. This comprehensive guide will delve into the nuances of estate and inheritance planning, its significance in personal and financial affairs, and the implications it has on individuals, families, and society as a whole. By understanding the principles and strategies involved in this process, readers can make informed decisions to secure their legacies and protect their loved ones.

Understanding Estate and Inheritance Planning

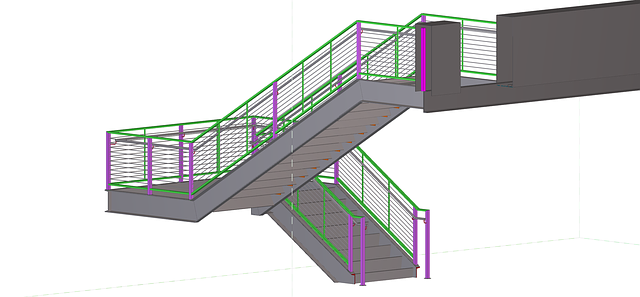

Estate planning is the process of anticipating and arranging for the disposal of an individual’s estate during their life and after their death. Inheritance planning, on the other hand, deals with the distribution of assets after a person’s demise. Both are integral to ensuring that one’s wishes are fulfilled, assets are protected, taxes are minimized, and beneficiaries are cared for. The core components include wills, trusts, powers of attorney, advance healthcare directives, and life insurance policies.

Historically, estate planning has been a practice among the affluent who had significant estates to manage. However, with the evolution of laws and the rise in asset protection strategies, it has become a prudent step for individuals across various economic strata. It fits within the broader landscape of financial planning, estate law, taxation policy, and personal wealth management.

Global Impact and Trends

The impact of estate and inheritance planning is not confined to any single region but has a global reach due to international marriages, migration, and the global nature of modern economies. Key trends influencing its trajectory include an aging population leading to more complex family structures, cross-border marriage and cohabitation, and changes in tax laws and property rights.

Developed countries with significant immigration populations, such as the United States and Canada, are particularly affected by these trends. In contrast, regions like Asia and Africa are seeing a rise in estate planning as the middle class expands and awareness of its importance grows. Additionally, the digitization of assets and the increase in business ownership among individuals are reshaping estate and inheritance planning practices worldwide.

Economic Considerations

Estate and inheritance planning plays a crucial role in economic systems by facilitating the orderly transfer of wealth, supporting entrepreneurship, and stimulating economic growth. It allows for the preservation of capital within families and communities, which can lead to long-term economic stability and prosperity. Market dynamics influence investment patterns, with a growing emphasis on tax-efficient strategies that align with estate planning objectives.

The economic considerations also extend to the impact of inheritance taxes and fees, which can significantly reduce the value of an estate if not properly planned for. Effective estate and inheritance planning can minimize these financial burdens, ensuring more of the estate’s value is preserved and passed on as intended.

Technological Advancements

Technology has revolutionized estate and inheritance planning through the development of digital wills, blockchain-based asset distribution, and online estate planning services. These advancements offer greater security, efficiency, and accessibility to individuals across the globe. The future potential includes AI-driven financial planning tools that can provide personalized advice and predictive analytics for wealth transfer.

Policy and Regulation

The legal framework governing estate and inheritance planning is complex and varies significantly between jurisdictions. Key policies and regulations include will execution laws, intestacy succession rules, inheritance tax legislation, and trust law. These policies not only dictate the procedures for creating a valid will or trust but also influence how assets are distributed and taxed upon death.

International agreements and treaties, such as the Hague Convention on the Law Applicable to Succession, further complicate matters by determining which country’s laws apply when an individual has connections to multiple jurisdictions. Understanding these legal intricacies is essential for effective estate and inheritance planning.

Challenges and Criticisms

Estate and inheritance planning faces several challenges and criticisms, including concerns over the potential for undue influence or coercion in the creation of wills and trusts. There are also issues related to the accessibility and affordability of estate planning services, particularly for lower-income individuals. Additionally, complex family dynamics can lead to disputes over the distribution of assets, which may result in costly litigation.

To address these challenges, a combination of legal reform, increased public education, and more accessible professional services is needed. Strategies such as community education programs, pro bono legal clinics, and simplified estate planning products can help democratize the process and ensure that all individuals have the opportunity to plan their estates effectively.

Case Studies

Several case studies demonstrate the successful application of estate and inheritance planning. One such example is the story of John and Mary, who worked with a financial advisor to create a trust for their minor children, minimizing estate taxes and ensuring the children’s assets were managed responsibly until they reached adulthood.

Another case study involves an entrepreneur who owned a significant portion of her company. Through careful planning, she was able to transfer ownership to her successor while preserving the value of her estate, avoiding what could have been a disruptive sale or division of assets upon her death.

Conclusion

Estate and inheritance planning is a critical component of personal financial management, with far-reaching economic, legal, and social implications. It requires a comprehensive approach that addresses the individual’s needs, family circumstances, and broader legal and economic context. As global trends and technological advancements continue to shape the landscape, the importance of thoughtful and informed estate and inheritance planning will only increase.

By considering the various factors outlined in this overview, individuals can make informed decisions about how their estates will be managed after they pass away. With the right combination of legal guidance, financial planning, and personal insight, estate and inheritance planning ensures that one’s legacy is honored as intended, providing security and peace of mind for both the individual and their loved ones.

Inheritance laws vary between states and countries, dictating asset distribution while respecting le…….

Collaborative estate planning, emphasizing open communication between beneficiaries and planners, tr…….

Estate planning tips promote integrating charitable giving into your strategy for a meaningful legac…….

The digital age has revolutionized estate planning by offering efficient, accessible, and secure onl…….

Estate planning involves creating legal documents (wills, trusts) to manage assets and fulfill indiv…….

Business succession planning ensures smooth ownership and leadership transitions, preserving a compa…….

Understanding inheritance laws is crucial for creating a robust estate plan that ensures your assets…….

Business succession planning, guided by estate planning tips, is crucial for entrepreneurs aiming to…….